Treasury Intervention: IRS Denied Access To DOGE Taxpayer Records

Table of Contents

IRS Denied Access to DOGE Taxpayer Records: Treasury Intervention Unlikely, Experts Say

WASHINGTON, D.C. – The Internal Revenue Service (IRS) has been denied access to taxpayer records related to Dogecoin (DOGE), a cryptocurrency, sources familiar with the matter have confirmed. This denial, the reasons for which remain unclear, has sparked speculation about potential regulatory hurdles and the challenges facing tax enforcement in the rapidly evolving digital asset landscape. While some have called for Treasury Department intervention, legal experts suggest such intervention is highly improbable given the established legal frameworks governing taxpayer data privacy.

The IRS, tasked with ensuring compliance with tax laws regarding cryptocurrency transactions, routinely requests access to relevant taxpayer information held by financial institutions and other entities. This access is typically granted under established legal authorities, such as the Internal Revenue Code and various information sharing agreements. However, in this specific case involving DOGE transactions, the request was rejected by [Name of Entity Denying Access – e.g., a specific cryptocurrency exchange or payment processor]. The precise date of the denial and the specific volume of data involved remain undisclosed due to ongoing confidentiality concerns. [Insert further detail about the scale of the denial, if available. For example: "Sources indicate that the denial affects potentially hundreds of thousands of transactions."]

The reasons behind the denial are currently unclear, but several possibilities are being explored. One theory centers on the inherent complexities of tracking DOGE transactions, particularly due to the decentralized nature of its blockchain and the prevalence of peer-to-peer exchanges outside traditional regulatory oversight. [Insert further detail about the technical challenges, if available. For example: "Experts point to the difficulty in definitively linking DOGE addresses to specific taxpayers, given the anonymity afforded by some platforms."] Another possibility involves ongoing legal disputes or disagreements concerning data privacy regulations and the IRS's authority to access such information under existing laws.

The lack of access to DOGE transaction data presents a significant challenge for the IRS in its efforts to collect taxes on cryptocurrency gains and losses. Taxpayers are legally obligated to report cryptocurrency transactions, including the sale, exchange, or use of digital assets for goods and services, as taxable events. The IRS has been stepping up its efforts to enforce these regulations in recent years, but the absence of key data significantly hinders its ability to identify and pursue non-compliant taxpayers.

Calls for Treasury Department intervention have emerged from some quarters, with suggestions that the department could use its regulatory authority to compel the release of the information. However, legal experts are largely skeptical of this possibility. [Name and Title of Expert 1] at [Name of Law Firm/University] argues that, "The Treasury Department's ability to intervene directly is limited by existing legal safeguards protecting taxpayer privacy. Unless a clear violation of law is demonstrated, a direct intervention would likely face significant legal challenges and could set a dangerous precedent." [Name and Title of Expert 2] at [Name of Organization] echoes this sentiment, stating that "The current legal framework generally prioritizes taxpayer confidentiality. While the IRS faces a significant challenge, forcing the release of this data would likely require a lengthy legal battle with uncertain outcomes."

The situation underscores the ongoing struggle to regulate the cryptocurrency industry effectively. As digital assets continue to gain mainstream acceptance, the need for clear and enforceable tax regulations, alongside effective data-sharing mechanisms, becomes increasingly urgent. The outcome of this situation will likely have significant implications for future IRS enforcement efforts and the development of cryptocurrency regulations. The IRS and [Name of Entity Denying Access] have declined to comment on the ongoing situation, citing ongoing internal reviews. This story will be updated as more information becomes available.

Featured Posts

-

All Passengers Released From Hospital Following Delta Air Lines Crash

Feb 22, 2025

All Passengers Released From Hospital Following Delta Air Lines Crash

Feb 22, 2025 -

The Curious Correlation Between Doge And Executive Departures At Musks Firms

Feb 22, 2025

The Curious Correlation Between Doge And Executive Departures At Musks Firms

Feb 22, 2025 -

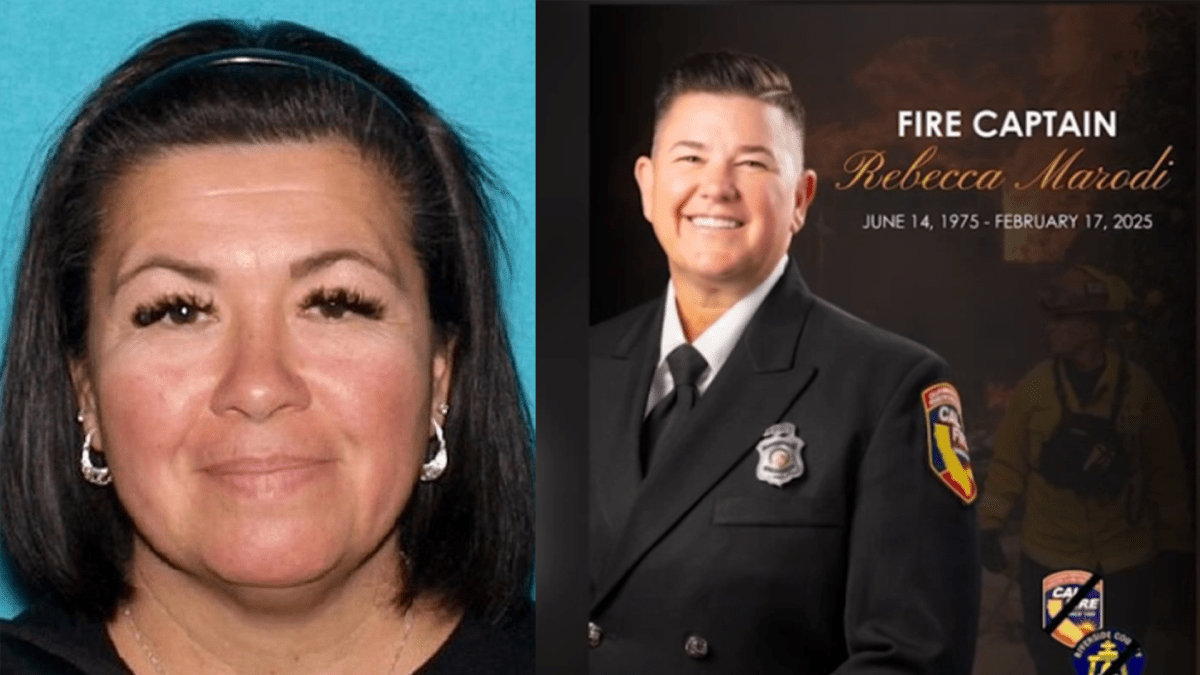

Cal Fire Captain Murder Suspect Apprehended

Feb 22, 2025

Cal Fire Captain Murder Suspect Apprehended

Feb 22, 2025 -

The Monkey Sets Box Office Record Second Highest Animated Film Opening

Feb 22, 2025

The Monkey Sets Box Office Record Second Highest Animated Film Opening

Feb 22, 2025 -

Researchers Link North Korea To Massive 1 5 Billion Bybit Crypto Theft

Feb 22, 2025

Researchers Link North Korea To Massive 1 5 Billion Bybit Crypto Theft

Feb 22, 2025

Latest Posts

-

Beterbiev Loses Rematch To Bivol Light Heavyweight Belt Changes Hands

Feb 23, 2025

Beterbiev Loses Rematch To Bivol Light Heavyweight Belt Changes Hands

Feb 23, 2025 -

From 17 Down To Victory Oregons Incredible Comeback

Feb 23, 2025

From 17 Down To Victory Oregons Incredible Comeback

Feb 23, 2025 -

Germans Head To The Polls In Crucial Election

Feb 23, 2025

Germans Head To The Polls In Crucial Election

Feb 23, 2025 -

Fleetwood Mac Album Inches Closer To Us Number One

Feb 23, 2025

Fleetwood Mac Album Inches Closer To Us Number One

Feb 23, 2025 -

Acting Ice Director Fired White House Pressure And Arrest Goals At Center Of Controversy

Feb 23, 2025

Acting Ice Director Fired White House Pressure And Arrest Goals At Center Of Controversy

Feb 23, 2025