Economic Concerns Raised Over Trump's Proposed DOGE Dividend

Table of Contents

Trump's DOGE Dividend: A Risky Gamble for the US Economy?

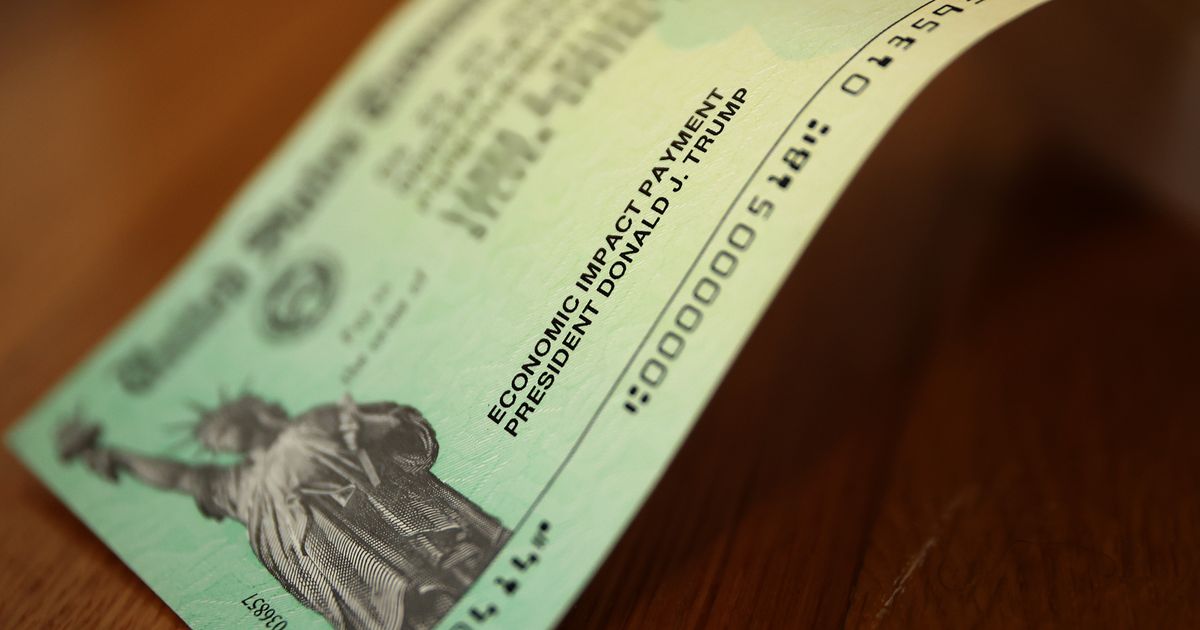

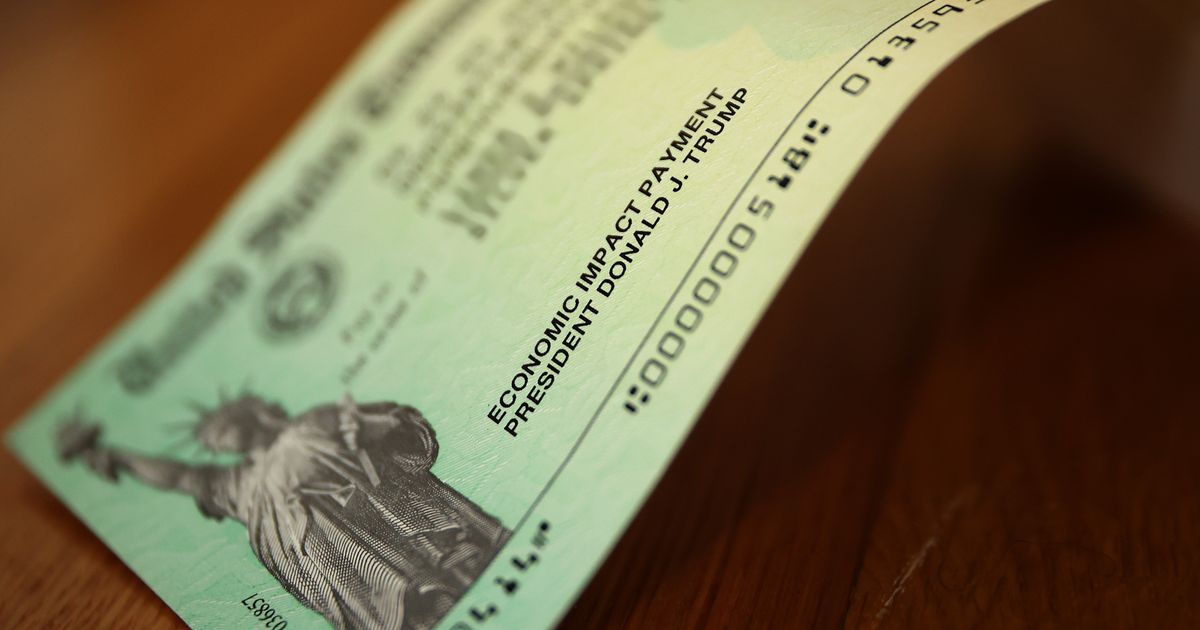

WASHINGTON, D.C. – Former President Donald Trump's recent proposal to pay a dividend in Dogecoin (DOGE) to every American taxpayer has ignited a firestorm of controversy, raising serious concerns among economists and financial experts about its potential impact on the US economy. While the exact details of Trump's plan remain vague, the mere suggestion has sent shockwaves through financial markets and sparked intense debate about its feasibility and economic consequences.

The core of the concern revolves around the inherent volatility and speculative nature of Dogecoin. Unlike established fiat currencies or stable cryptocurrencies, DOGE's value fluctuates wildly based on market sentiment and social media trends, making it a highly unreliable asset for a large-scale government payout. A sudden surge in demand, driven by the government distribution, could lead to a temporary price spike, followed by a potentially dramatic crash as investors attempt to cash out, leaving many recipients with significant losses.

[Initial proposed amount of dividend per taxpayer: While Trump's campaign hasn't released a specific figure, various reports suggest potential values ranging from $100 to $1000 per taxpayer. The actual amount, however, remains unconfirmed and subject to considerable speculation.] The sheer cost of such a dividend, even at the lower end of estimates, would be astronomical, potentially exceeding trillions of dollars. This would necessitate a massive increase in the national debt or drastic cuts to other government programs.

[Source of funding for the dividend: Trump's proposal lacks clarity on the funding mechanism. It's unclear whether he envisions using existing government funds, issuing new debt, or implementing some form of unconventional monetary policy. This ambiguity exacerbates the economic uncertainty surrounding the plan.] The lack of a clear funding mechanism fuels concerns about the potential for inflation, as a massive injection of DOGE into the economy could devalue the currency and erode purchasing power.

Furthermore, the practical challenges of distributing DOGE to millions of taxpayers are substantial. [Proposed distribution method: No detailed distribution plan has been publicly released. This raises concerns about potential fraud, technical glitches, and the administrative burden on government agencies. The existing infrastructure for distributing federal payments isn't designed to handle cryptocurrency transactions on this scale.] The lack of a comprehensive plan only amplifies these concerns.

Economists from across the political spectrum have expressed deep skepticism. Professor [Name of prominent economist and their affiliation], for example, argues that “such a plan would be economically irresponsible and reckless, potentially triggering a financial crisis.” Other experts have highlighted the risks of exacerbating income inequality, as the volatile nature of DOGE could disproportionately benefit those with more technical expertise or access to sophisticated trading platforms.

Beyond the immediate economic consequences, the proposal raises broader questions about the role of cryptocurrency in government policy. Critics argue that using a highly volatile asset like DOGE for a national dividend undermines the stability and credibility of the US financial system. They contend that such a move would send a damaging signal to global markets, potentially jeopardizing America’s economic standing.

The long-term impact of Trump’s DOGE dividend proposal remains highly uncertain, but the potential for economic disruption and instability is undeniable. As details of the proposal emerge, further analysis and scrutiny from economists and policymakers are crucial to assess its full implications and mitigate potential risks. The ongoing debate underscores the need for careful consideration of the economic ramifications of integrating cryptocurrencies into national fiscal policy.

Featured Posts

-

Soaring Insurance Costs In 2025 A Doctor Sounds The Alarm

Feb 25, 2025

Soaring Insurance Costs In 2025 A Doctor Sounds The Alarm

Feb 25, 2025 -

Investigation Launched After Cyclist Paul Varry Killed In Paris

Feb 25, 2025

Investigation Launched After Cyclist Paul Varry Killed In Paris

Feb 25, 2025 -

Candid On Set Photos Reveal Actors Real Sides

Feb 25, 2025

Candid On Set Photos Reveal Actors Real Sides

Feb 25, 2025 -

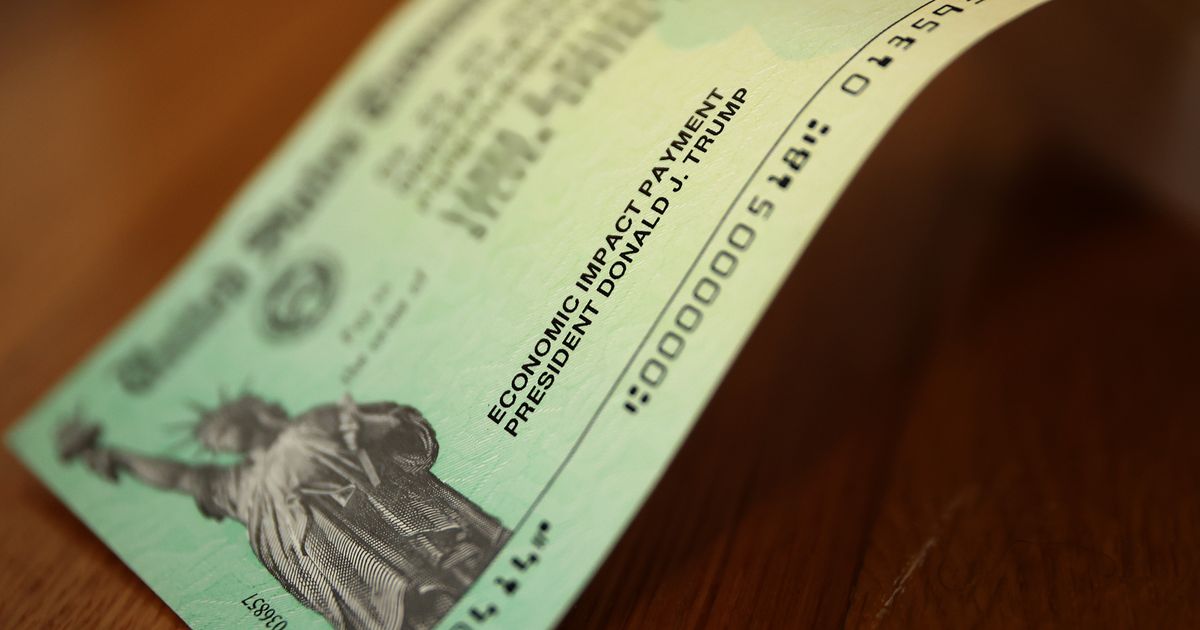

Veterans Detainment By Ice Wifes Account Of The Arrest

Feb 25, 2025

Veterans Detainment By Ice Wifes Account Of The Arrest

Feb 25, 2025 -

Lost In Utah How An Abandoned Backpack Helped A Father And Son Survive

Feb 25, 2025

Lost In Utah How An Abandoned Backpack Helped A Father And Son Survive

Feb 25, 2025

Latest Posts

-

Is A Dogecoin Dividend Feasible Assessing Trumps Economic Proposal

Feb 25, 2025

Is A Dogecoin Dividend Feasible Assessing Trumps Economic Proposal

Feb 25, 2025 -

The Potential Fallout Examining Trumps Proposed Dogecoin Dividend

Feb 25, 2025

The Potential Fallout Examining Trumps Proposed Dogecoin Dividend

Feb 25, 2025 -

Musk Seeks Accountability Explanations Demanded From All Federal Workers

Feb 25, 2025

Musk Seeks Accountability Explanations Demanded From All Federal Workers

Feb 25, 2025 -

Lockerbies Legacy A Mother Creates A Powerful Memorial To The Victims

Feb 25, 2025

Lockerbies Legacy A Mother Creates A Powerful Memorial To The Victims

Feb 25, 2025 -

Analyzing The Landscape A Look Ahead To Germanys 2025 Federal Vote

Feb 25, 2025

Analyzing The Landscape A Look Ahead To Germanys 2025 Federal Vote

Feb 25, 2025